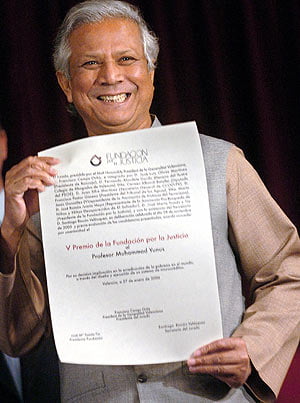

The Foundation for Justice presents its V award to Muhammad Yunus, creator of microcredits for poor people

The Foundation for Justice presents its V award to Muhammad Yunus, creator of microcredits for poor people

Muhamed Yunus, creator of the Bank of the Poor in Bangladesh, has received in Valencia the fifth prize from the Foundation for Justice in recognition of his work that over the last 20 years has made it possible to grant two million dollars in credit so that 3.5 millions of people leave poverty.

During the presentation ceremony, the winner highlighted that the microcredit system implemented by the Grameen Bank Since its creation in 1983, it can make us think "of a world in which there is not a single poor person."

96% of the credits promoted by this entity, which can only be accessed by people who do not own land, have been granted to women, a 56% of which has managed to leave extreme poverty.

Yunus has expressed his satisfaction with these results, since "the children of these women will also escape poverty" and all of them go to school, while nearly 100,000 young people pursue university studies.

'We are all responsible'

"It is a fascinating experience to see that in this background of illiteracy these people can go out and study," highlighted the winner, who was convinced that "If things are done correctly, there will be no poverty". For Yunus, poverty does not arise from those who suffer from it, but from the systems created by "everyone", truly responsible in his opinion for the current "extreme" situation.

For his part, the head of the Valencian Executive and president of the jury for this award, Francisco Camps, has assured that Yunus "has left a seed" that will allow Valencian society to become "a Grameen society" and collaborate in his project, since that its objective is "to find the way to get that model right".

Camps has highlighted that Yunus has been chosen for this award among 29 other candidates for being a man who "for about 30 years has dedicated his efforts to doing business with those who have nothing."

Recently, the 'father of microcredits' has signed an alliance with the Red Cross to introduce this financial instrument in all African countries in the next ten years.

Source and image: EFE